SALE OF INDIRECT PIX PAYMENT INSTITUTION

We are offering for sale a payment institution that operates on the indirect PIX model. Some relevant information about the offer is detailed below…

A Arariwe acts as a HUB integrator, specialized in building and accelerating fintechs, combining expertise in technology, finance, data and regulatory to offer technological financial solutions.

Our purpose is to boost the global movement of financial resources, making it more accessible, safe and effective for everyone.

Hover for more details.

We offer complete solutions to create banks in the digital environment, combining cutting-edge technology with friendly user interfaces. Our focus is on providing comprehensive functionality such as account management, banking and customer service, all accessible online.

We develop personalized credit solutions, including loans, financing and lines of credit. Our systems are designed for agile and accurate risk analysis, facilitating informed decision-making.

Front Side Text Description

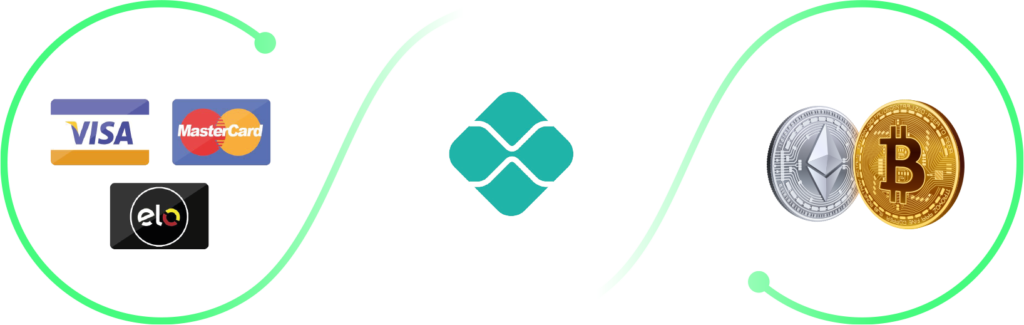

We implement payment gateways that guarantee fast, secure and efficient transactions. These systems are optimized for a variety of payment methods, including flagged transactions, Pix and boleto.

We create solutions for issuing credit and debit cards, taking advantage of the extensive Visa and Mastercard networks. Our services include card personalization, integration with rewards programs and advanced security technologies.

We explore the potential of blockchain and decentralized finance, offering tokenization and cryptocurrency services. Our approach focuses on security, transparency and innovation, enabling new possibilities for financial transactions and investments.

Our consultancy helps you prepare a robust business plan adapted to the needs of the digital market. We define clear goals, action strategies and financial projections to ensure the sustainable growth of your digital bank.

We identify the best solutions and financial products to make up your bank's offer. Based on market trends and customer needs, we structure a range of competitive and innovative products.

We offer tools that allow you to simulate financial scenarios, helping to predict risks, opportunities and the bank's financial health in the short and long term.

We ensure that all of your bank's operations and products comply with current regulations, minimizing risks and ensuring the integrity of transactions.

We assist in the legal structuring and CNPJ registration process, ensuring that your digital bank

is duly regularized before the competent bodies.

We act as a bridge between your bank and the best technology providers, ensuring cutting-edge solutions and efficient integrations.

We offer full support in the Know Your Provider (KYP) process, ensuring that technology partnerships are aligned with your bank's goals and values.

We develop and optimize operational and financial processes, ensuring efficiency, agility and security in all bank operations.

With a strategic vision, we plan each stage of the project, from conception to implementation, ensuring that all actions are aligned with the objectives of your digital bank.

We focus on the fluid implementation of Api's and partner data, ensuring that integrated solutions increase the capacity and efficiency of your fintech. Our personalized approach aims for a perfect synergy between the different technologies, ensuring a robust and innovative infrastructure.

We implement and manage pilots in productive environments, allowing us to test and improve fintech operations in real market conditions. This phase is crucial for identifying areas for improvement and ensuring the launch is successful and problem-free.

We design effective strategies for fundraising and investment intermediation. Our focus is on connecting investment opportunities with potential investors. We offer complete support in negotiating and structuring investment agreements, aiming to maximize returns and minimize risks for our partners.

At Arariwe, all our solutions are the result of strategic partnerships with major technological providers in the financial market. We position ourselves as a financial technology integrator hub, combining expertise, innovation and the capacity of major players in the sector to deliver cutting-edge solutions. This approach allows us to build and implement high-impact financial solutions, ensuring efficiency, security and a superior user experience in every project we participate in.

BaaS, CaaS, Open Finance, PIX.

BaaS, PIX.

Payments.

Mobile apps.

Payments.

Credit data and analysis.

Cards.

Credit operations.

Financial services.

KYC and identity checks.

Risk management.

Cryptocurrencies.

Credit card.

BNPL and Pl.

The Arariwe Gateway acts as a Centralizing hub for Financial APIs, interconnecting a wide range of technology providers into a single access point. (One Stop Shop) Its main objective is to function as an efficient integrator, specialized in processing financial transactions.

Robust APL's facilitate integration with your systems, ensuring stable and secure financial operations.

Connections with several providers, minimizing the risk of service failures and offering innovative strategies.

Reduced rates through the partnership with Arariwe, boosting the profitability of your business.

Automatically switching and distributing load between providers, optimizing operational efficiency.

Resources to track and reconcile transactions, improving financial management.

Security for your transactions through powerful anti-fraud tools plugged into the gateway.

Complete account and configuration management, facilitating transactions, viewing detailed reports.

Monitor the performance of your financial transactions in real time.

M&A Consulting (Mergers and Acquisitions) for Fintechs is a strategic specialization that facilitates and optimizes merger or acquisition processes in the dynamic technological financial sector. Our consultancy offers a complete and detailed service to ensure that complex transactions are carried out efficiently and transparently, avoiding unpleasant surprises and ensuring a successful integration.

With a team of fintech experts and a global network of partners, we offer strategic insights and personalized planning for each phase of the M&A process. Our commitment is to the excellence and long-term success of our clients' operations in the technological financial market.

Choosing our M&A consultancy means ensuring a well-founded, strategic negotiation with the lowest possible risk. We transform complexity into clarity and risks into opportunities.

In-depth assessment of the company's financial conditions, including profitability, cash flow, debts and growth potential.

Preparation of detailed financial reports for an accurate assessment of the company's value.

Examination of technological infrastructure, software, intellectual property and innovations.

Assessment of the scalability of technological solutions and compatibility with existing systems.

Rigorous investigation to ensure compliance with financial laws and regulations.

Analysis of legal, contractual and regulatory compliance risks

Study of the corporate environment, values, leadership practices and alignment between the cultures of the companies involved.

Assessing cultural impact on post-acquisition integration to facilitate a smooth transition and maintain team morale.

We are offering for sale a payment institution that operates on the indirect PIX model. Some relevant information about the offer is detailed below…

Arariwe is a dialect word Yanomami and means “spirit of the macaw”. For the Yanomami people, the Macaw is an animal of power that represents creativity and expansion of consciousness with the purpose of flying high, and that is what we believe we can do through digital financial products.